TfL finance fight round 3: Will London get £3 billion bailout?

At the end of March bailout number three for TfL will be needed – and this time the stakes could be the highest yet.

The deal should be the last shortly before the Mayoral election on 6th May – assuming it doesn’t overrun as talks last time did. But that was days, and not five weeks as would be needed next time.

I’ve been browsing the February 2021 TfL board papers (as you do) to see how finances were shaping up. The new national lockdown makes much of it somewhat academic, as agreement for bailout number two did not foresee such a long lockdown and most numbers only run until early January.

Data showed the congestion charge increase announced dafter earlier bailouts brought in greater amounts of revenue but nowhere close to meeting the reduction of fare income. Weekly increases of £1.9 million before lockdown number three were offset by reduced income from the tube network alone of up to £42 million. Bus journeys were bringing in £11 million per week less than normal.

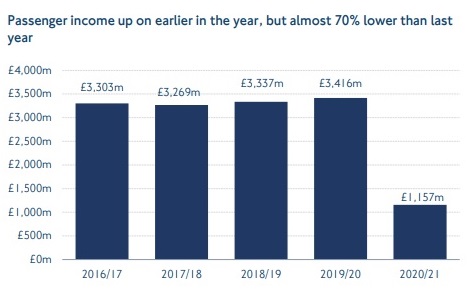

Before lockdown number three, passenger numbers and incomes were better than expected earlier in 2020 which offers hope for the future.

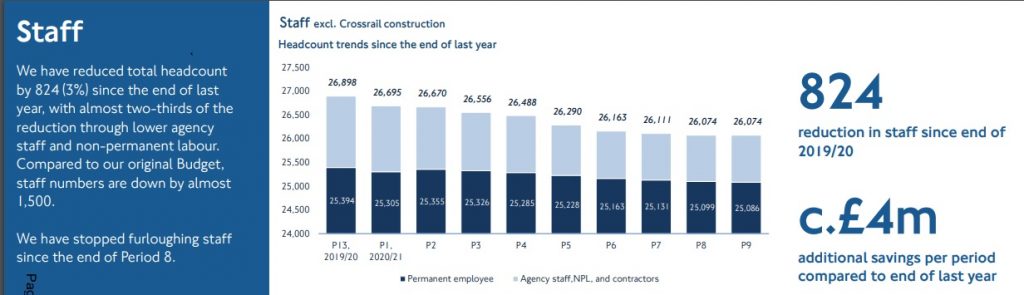

The report contains snippets of interest in terms of the impact upon TfL, and over the past year TfL have reduced staffing numbers by 824 – or 1,500 compared to the original budget. Fare rises will be introduced next week.

In addition, the organisation states: “Around £3bn in financial support will be needed from the Government in 2021/22. While the medium to long-term impact of the pandemic on travel demand is unknown, a significant financial gap will remain over the in the nearer term.”

That £3 billion is not coming without a fight.

One of the biggest will be TfL’s future budget that “assumes receipt of £500 million per annum from Vehicle Excise Duty or a possible new Greater London Boundary Charge, which is something that would need to follow statutory processes, including consultation”.

The ULEZ scheme is also now predicted to bring in less than forecast, as the vast majority of vehicles will be exempt.

The move to retain taxes derived from London drivers to be spent within London now has cross-party support within the capital. Whether the Treasury agrees is another matter. They didn’t in 2018.

- Become a monthly supporter at Patreon or make a one-off donation to help bring you news and coverage via Paypal

- There is now a From The Murky Depths Facebook page. Click here to follow and see stories on your Facebook feed.

Almost exactly one year ago today I wrote about possible impact of the pandemic upon transport. Back then I stated a 10 per cent fall in passengers would have a massive impact. Little did we know.

Fare income reduction

As reported before, TfL now sees no operating support from central Government. A situation almost unique in the developed world. Thus the organisation is reliant on fares to a far higher degree than other major world cities such as Paris and New York.

Enter pandemic stage left, and chaos is the result as fare income dries up.

For example, Paris gains a percentage of employee tax to fund it’s network. Hong Kong on the other hand uses property and land along lines to cross-subsidise. TfL are moving in that direction but face restrictions from central Government and havn’t covered themselves in glory on sites such a Woolwich DLR station where 13 years after a joint agreement was signed, not a single application has been submitted.

There’s always the risk government will force land to be sold, and Network Rail did likewise when forced by central government to sell land and arches in 2019. This removed ongoing income to help support rail maintenance and expansion, and could see hefty bills to secure land for engineering work in future according to a report from the public accounts committee. Tenants such as Deptford businesses have complained of increased rents since the sale.

Given the latest reopening plan announced yesterday (22 February) foresees the economy opening up slowly, and not fully by the end of June, it’ll be some time before passenger numbers even reach levels seen last summer. The Treasury can support London in the interim, embark on political brinkmanship to support their candidate in the forthcoming election or refuse to support to proposed levels but open up devolution and enable local retention and raising of revenue such as London VED income and other taxes such as a tourist tax – again a common feature across the world.

This government isn’t one known for loosening its grip on central power and given the games played in the lead up to October’s bailout brinkmanship is perhaps the option to be played out. Back then plans to extend the congestion charge were mooted from government but faced a wave of hostility. They could try it again in the hope it benefits Shaun Bailey – though that tactic seemed to backfire last time.

Whatever option is taken is unlikely to benefit London in the short term. As the economy reopens the real risk remains that a car-dominated recovery is at the heart of it. If you think LTN causes traffic problems, a mass switch from public transport to cars will be on another level.

In coming weeks leaks and details will begin to drip out. Candidates for Mayor will go big on tweets and statements as will government ministers and MPs as propaganda flies. In the middle will be the city’s residents facing higher fares, fees and cuts.

- I run the site myself unpaid. Become a monthly supporter at Patreon or make a one-off donation to help bring you news and coverage via Paypal

- There is now a From The Murky Depths Facebook page. Click here to follow and see stories on your Facebook feed.

Running a site alone takes time and a fair bit of money. Adverts are far from enough to cover it and my living costs as a private renter.

You can support me including via Paypal here Another option is via Patreon by clicking here You can also buy me a beer/coffee at Ko-fi here There's also a Facebook page for the site here Many thanks

Ah well, at least we spent an eye watering amount on that fireworks display nobody asked for… nice one Khan

It costs a pittance in the overall GLA budget and is broadcast all over the world highlighting London. Incredibly cheap advertising.

In terms of enhancing London’s image around the world and promoting it as a tourist destination, you only have to look at the comments on any ‘London NYE fireworks’ video On YouTube to see that this 12 minutes every 1st of January probably brings in far more in tourist ££ revenue than they cost. For London to recover we’re going to need all the tourists we can get to fill our hotels, museums, restaurants, theatres, buy ice creams, umbrellas and sandwiches and use our airlines, airports, trains and buses, so it was a shrewd investment. The special twist of the use of illuminated drones kept the cost and the pollution down and stole many admiring glances from around the world and comments that it blew other, more costly traditional displays such as Dubai out of the water. Many comment that they want to come and see it ‘live’ and the 100k tickets ALWAYS sell out in ‘normal’ years, so a tradition well-kept that will reap dividends in the coming year.

If you want something to moan about, try this: I bet he procured the fireworks honestly though and didn’t quietly bung his mates tons of public cash like others we could mention have been doing all year. We won’t need a Public Enquiry to get to the bottom of where the sparklers came from. We can’t say that about the PPE. The fireworks also all worked, tons of that shifty PPE had to be thrown as being substandard…