Greenwich Council continue to deny issues as developer income lags by millions

Issues surrounding low levels of income from developers to fund services and infrastructure in Greenwich borough came up at a full council meeting this week as income lags and Greenwich sit near bottom in the capital for raising revenue despite high levels of building.

In response to a question from Cllr Spencer Drury (Conservative – Eltham North), Greenwich Council’s Cabinet Member for Finance and Resources Cllr Linda Perks (Labour – Charlton) gave a reply that’s worth looking into and comparing to what’s happened over the past six years to see why there’s been minimal income despite high levels of new housing and development.

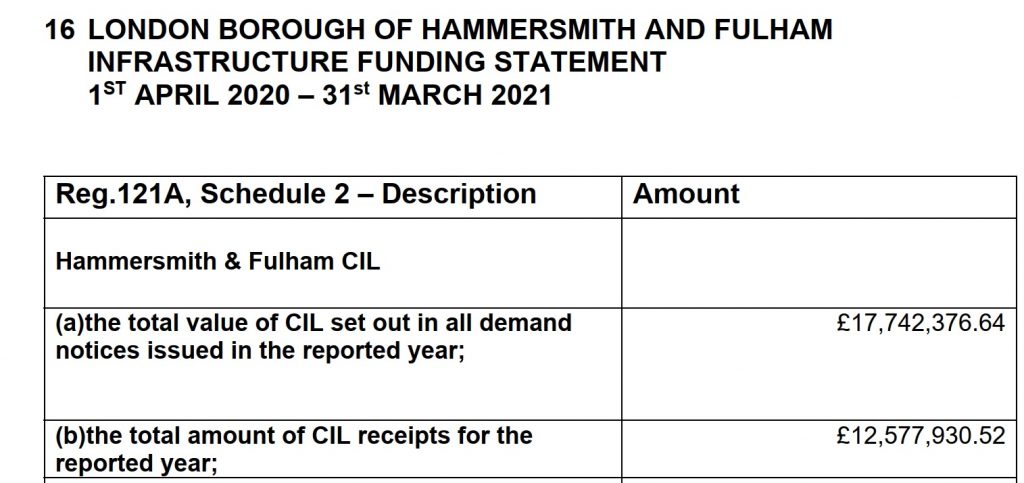

It was recently revealed that Greenwich sit near the foot of the table in London since the Community Infrastructure Levy was introduced in 2015 – and in some cases lag London boroughs by many tens of millions. They also missed their own estimate for total income by 2021 of £27.5m, with £9.7m received by March 2021. Due to inadequate income, zero is being spent on community services and facilities as they havn’t made their Crossrail repayment target.

One thing that stood out at this week’s council meeting is Cllr Perks stating “The CIL rate adopted in 2015 was the best rate that could be secured at the time“.

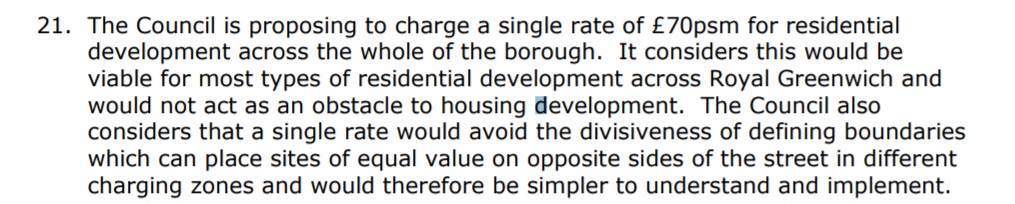

However, if we look at the 2015 report drawn up by the Planning Examiner after negotiations with the council, certain sections contradict that claim with the report stating it was the council that proposed a low £70 per square metre rate for residential development. That was far below what other boroughs covering Zones 2-4 were applying. This is an extract from that 2015 report with a very clear first sentence of who chose that £70 rate:

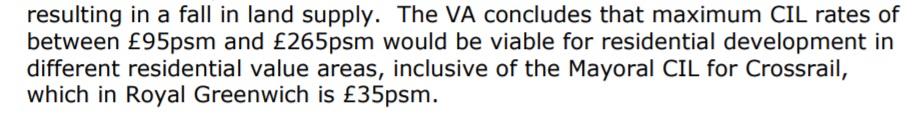

The same 2015 report states that a Viability Assessment concluded that up to £265 per square metre could be charged in places, inclusive of the Mayoral element which back then was £35 psm and is now £25 psm. Thus Greenwich could have gone for £230 psm for the borough element of CIL but chose £70. That does not match the line that £70 “was the best rate that could be secured at the time” now being made week.

The report is clear that “The VA concludes that maximum CIL rates of between £95psm and £265psm would be viable for residential development in different residential value areas“. Thus areas of high value such as Greenwich in the west could have seen a higher CIL rate for increased revenue to fund public services and improved infrastructure.

It didn’t happen, and so developers behind projects such as this block in Greenwich town centre, photographed recently, are paying far below what was considered possible:

Greenwich Council also chose a low rate to avoid “divisiveness of defining boundaries” despite that being the norm all over London. I’ve looked through annual CIL reports for every London borough and it’s common practice.

Greenwich were however forced to adopt two zones, with areas to the east reduced to £40 psm while the same low £70 psm was still retained and not increased to the maximum level possible.

The reason they pushed for a single rate was the claim that a single rate would be “simpler to understand and implement”. That’s not been an issue for other London authorities, the majority of which have seen far larger income totals since 2015.

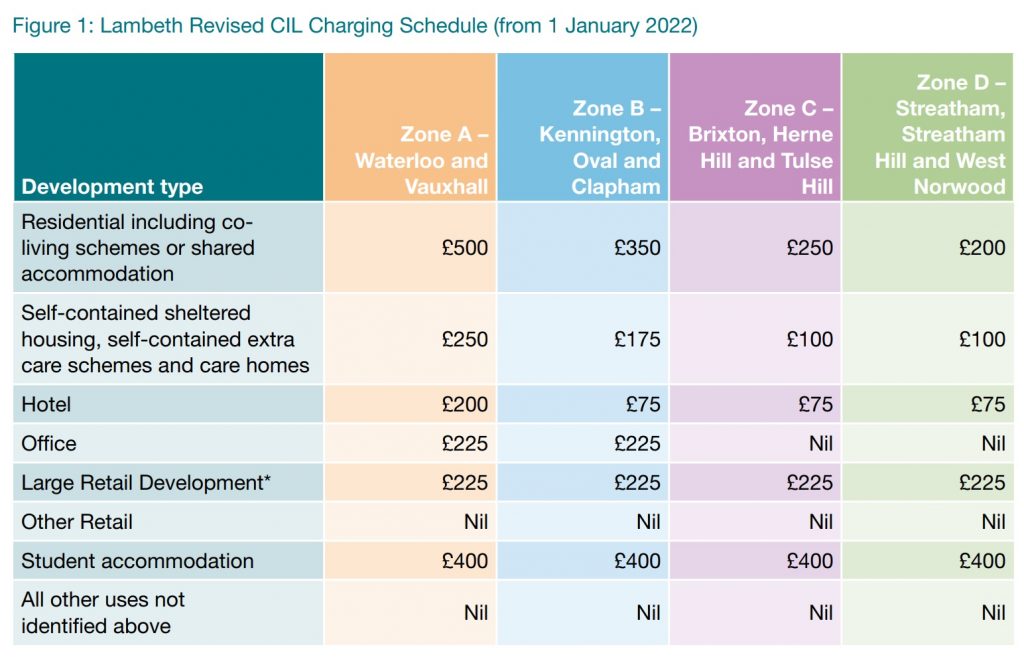

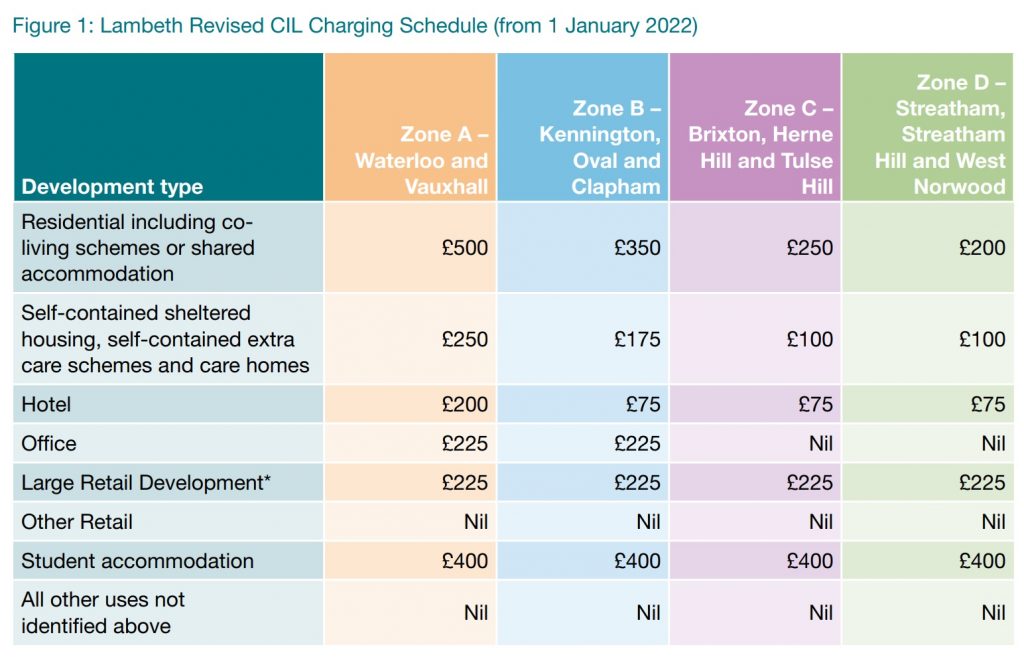

Take Lambeth for example. They have four zones, and have revised totals. That’s key, and I’ll cover why below.

Berkeley Homes pushed for low rates in 2015 when £120psm including Mayoral CIL (so £95 psm for the borough element ) was possible in Woolwich and Kidbrooke: “Berkeley Homes, the main residential developer within the strategic development locations at Woolwich and Kidbrooke, is concerned that this would put regeneration of these areas on the margins of viability and fails to recognise the higher infrastructure costs involved in redeveloping these strategic locations.”

Poor old Berkeley Homes have of course since struggled on the breadline.

2018 review

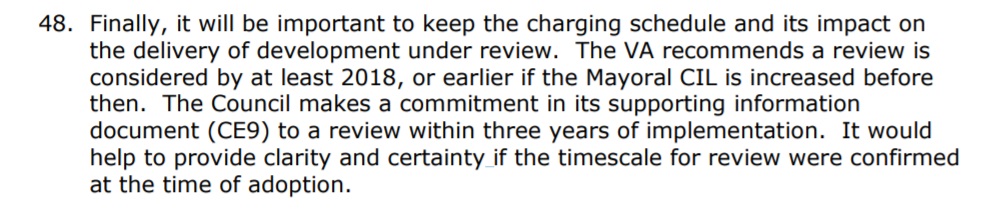

One issue Cllr Linda Perks never mentioned is that the same 2015 report committed to a review of income by 2018. There’s no sign this ever happened. If it had, income would almost certainly be higher by now. Many London boroughs that started with higher rates than Greenwich in 2015 have since reviewed and pushed up yet further with no detrimental impact on new housing.

In 2015, the report clearly stated the “VA recommends a review is considered by at least 2018”.

It also stated “The council makes a commitment in its supporting information document to a review within three years of implementation”.

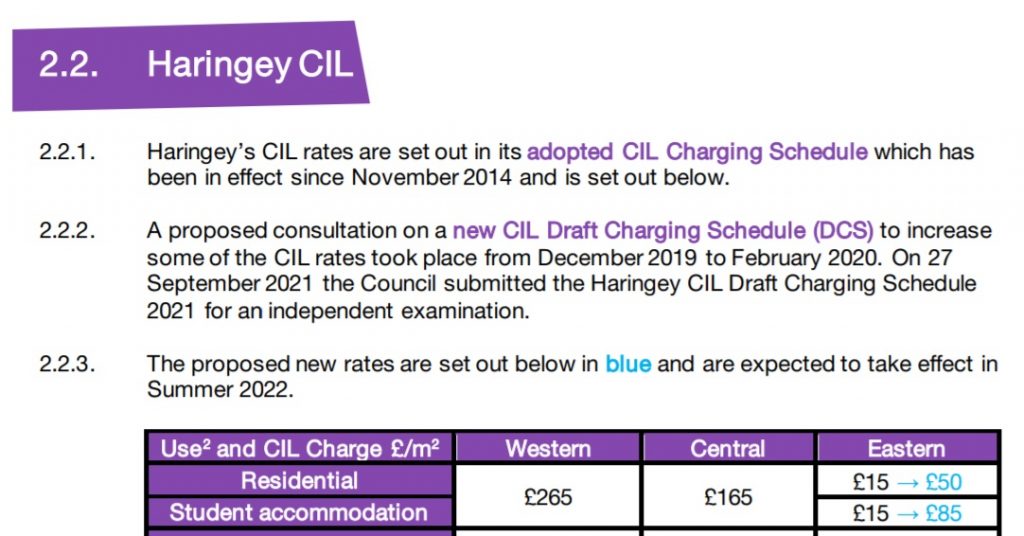

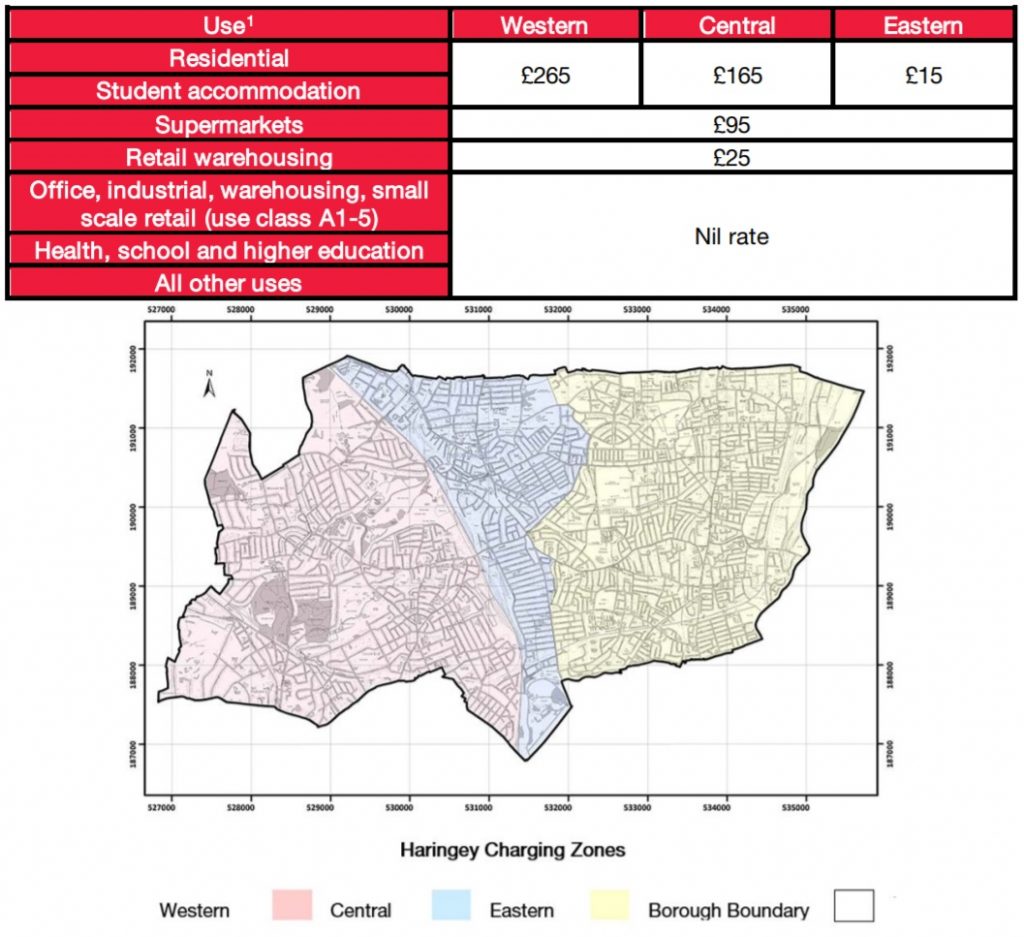

Reviews can take some time, so it was key that happened yet charging rates have never been adjusted. There needs to be consultation and then a report submitted. No sign of that in Greenwich. Haringey, to give another example, have already gone thorugh the process and revision will begin soon. It’s another borough that had no trouble with multiple zones:

Six years after the 2015 CIL report which saw Greenwich committed to a review within three years and not conducting one, they started mentioning one six years later in September 2021 and it taking 18 months. However the reply this week in the council meeting still mentions 18 months. If it had begun last autumn we should be looking at 12 months now. Has it actually progressed at all? There’s nothing in Cllr Perk’s reply to suggest it has. There’s been no consultation let alone a submission.

More bad news is that this financial is set to once again see very low levels of income. We know that by the end of March 2021, £9.7 million had been received against a 2015 estimate of £27.5 million.

Cllr Perk’s reply stated that they now have £11.5m in CIL income from 2015. That means less than two million in income this financial year with two months to go – and on track for another very low total by London borough standards.

Transparency

Cllr Perks also stated this week: “CIL receipts are driven by commencement of development and so additional resources were secured mid-way through 2021/22 to increase capacity to monitor development and identify schemes that may have commenced without informing the Council”.

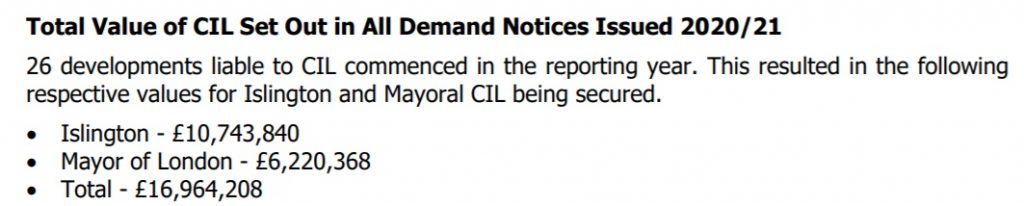

What wasn’t mentioned is that Greenwich Council’s annual reports on Community Infrastructure Levy are alone in London for not containing crucial information including Demand Notices issued to developers.

I’ve looked at CIL reports for every London authority and Demand Notices for payment issued by council’s are included as a matter of course – except in Greenwich. This is crucial for obtaining income and offering a guide to future revenue.

Last year they found a possible £1.8m unpaid when finally allocating staff to look into it. Since 2015, they’ve also failed to allocate the maximum possible amount of income to administer the scheme and fund staffing costs. They can use 5 per cent of CIL income for staffing. They chose 4 per cent. one per cent may not seem much, but when revenue is in the millions it counts.

Masterplans

Another response heard in recent years and repeated again this week is “Some of the large schemes (e.g., Kidbrooke and Royal Arsenal) currently being implemented in the borough actually secured their permissions prior to the introduction of CIL, meaning that developer contributions were secured through the Section 106 regime, rather than CIL. For those schemes granted permission prior to the adoption of the Greenwich charging schedule, Borough CIL will only be collected if those permissions are subsequently varied, and in these instances only on any uplift in floorspace created by the variations.”

However the level of development across the borough goes well beyond those areas, and both of those sites have seen revisions since 2015 with total homes increased. Kidbrooke saw 500 extra homes approved recently. Speaking of Kidbrooke, work on hundreds of homes to the north of the station aside from Kidbrooke station is now well underway. That alone should see healthy income – though the low £70 rate will hit there too.

Student housing

Student housing has been popular in the borough and will continue to be so. The Viability Report determining CIL rates concluded a maximum rate of £118psm was possible including the Mayor’s £35psm. Thus Greenwich could have gone for £80psm. They didn’t. The 2015 report states “The Council proposes a rate of £65psm for student housing.”

The Mayor’s CIL rate actually reduced from £35psm to £25psm for Greenwich in 2019 – and so Greenwich would be able to add £10psm without impacting on viability at all even discounting all other factors. A review would have seen that happen.

Hotels

Another area where Greenwich chose a low rate is hotels with £100psm. The 2015 report states: “Hotel schemes could absorb a maximum CIL of between £259psm and £501psm. I note that this is based on the cost assumptions of a central London hotel scheme at Bethnal Green, which provides a more comparable location for Royal Greenwich than the outer London scheme at Whetstone”.

Numerous hotels have been built since 2015 which have paid rates below what was possible. Others look likely to begin before any revisions are made, including in Greenwich:

Here’s another:

Future

If Greenwich had finally begun the process of revising rates last September – as previously stated by the authority – then revised rates may in place by early 2023 ensuring uplift in income to fund numerous improvements borough-wide.

If not, it could be later in 2023. That gap could be crucial, as there’s many large projects that may sneak in before an uplift which will costs millions in lost revenue. Given no consultation it appears it will take some time.

Anyone who reads this site know large development plans are a regular occurrence. One example is 1,300 homes near Ikea in Greenwich:

If that project gains approval and begins before changes are made the repercussions for services will be huge. It’s a similar story at sites such as Morden Wharf (1,500 homes) and even smaller scale projects such as the former Greenwich Town Hall:

If Greenwich miss out it’d be the latest in a long line of failure. They adopted a very low rate in 2015 against what the Viability Report stated was possible at the time and chose a low flat rate which benefitted developers.

They then failed to revise rates in 2018 despite falling well below expected income.

Finally, if they’re now dragging their feet and allowing multiple developments to get away with paying a low £70 psm rate, millions more will be lost. When all’s said and done, tens of millions that could have been transformative have been lost. All this time the authority have attempted to blame others, but the 2015 CIL report makes some very clear statements on who chose the low rate, what rates were possible and what should have happened in 2018. Add in current doubts over timescales to reform rates and it’s a failure that falls firmly at the door of the council – with repercussions on a whole range of services and areas.

Running a site alone takes time and a fair bit of money. Adverts are far from enough to cover it and my living costs as a private renter.

You can support me including via Paypal here Another option is via Patreon by clicking here You can also buy me a beer/coffee at Ko-fi here There's also a Facebook page for the site here Many thanks

Your analysis once again John is thorough, investigative, illustrated well with examples, comparisons among boroughs, photos and downright damning of our council. These people are being paid a fairly decent salary to manage funds, yet your exposees (on a budget) are more detailed than we ever see from them until it’s once again too late, stable door shut after the horse has bolted. Amidst my distress and anger over this issue which has been highlighted before, I can only hope the opposition parties pick up on your public analyses and use in electioneering. Much as your blog is widely read I’m sure, it needs ‘every’ household to be aware and decide what action they feel approp. 3 cheers matey.

You mentioned Berkeley Homes not suffering financial loss, the profits of Berkeley Homes Public Limited company were, last year, just over half of those the year before. This still amounted to £96,979,000. This makes one ask, is it just their deep pockets that are benefiting? (Figure from Companies House website)

Thank you. John another very thorough and informative article. Witt out you local residents would not have a clue what is happening in the Borough. As this information is not provided elsewhere.

Brilliant analysis yet again. It really shows up greenwich council and the leadership

@CDT: I am sorry to say that the local electorate is not really interested in politics. It keeps voting Labour on the basis that it is not the Tories. However, even if Labour could be prised out of office, the experience of a minority party in government is not good – the LibDems in national government and the Greens in Brighton and Hove.

They are definitely struggling in Kidbrooke Village selling 1 bed apartments at c£500k, 2 bed at c£600k and 3 bed at c£900k.

I still recall their warning several years ago that the project wouldn’t be economically viable unless they built more apartments and higher .Months later the directors shared multi million bonuses.

Shouldn’t local authorities be subject to independent auditing occasionally? Surely this failure by the current incumbents in the handling of public money ought to be called out by auditors? I seem to recall that Westminster councillors were held personally responsible for their shenanigans back in the 1980s. So what’s happened to independent oversight? Great piece of research though Murky and let’s hope some of the sh*t does hit the fan soon.